An alternative investment route into UK residential property through Joint Equity Bonds an alternative to Buy to Let.

With ever tightening mortgage criteria lenders are restricting mortgage supply, to owner occupiers and Buy to Let landlords, but demand from home owners and property investors is higher than ever.

Joint Equity Co-Ownership provides the solution to both home owners and property investors.

The Joint Equity Scheme offers 50% home ownership to aspiring home owners which is an attractive alternative to renting with the other 50% is own by the JEIP which sells its Bonds offering attractive annual returns with terminal bonuses.

The irony of the property market today is the would-be home owner is often paying the same or more in rent than the equivalent mortgage but they are still declined a mortgage.

The Joint Equity Scheme and our Bonds offers the perfect options for both residential property investors and aspiring home owners.

There are 3 main routes into UK residential property market

- Buy to Let – becoming less attractive and difficult by the day.

- Institutional Residential funds – low yields and only traps the resident in rented for longer.

- Joint Equity Co-Ownership Bonds – higher yields, ethical and reduced risk.

Buy to Let For property investors the traditional route into UK residential property is through Buy to Let however, it has suffered sustained attack by the Government and European regulation. These include:-

- Increased punitive stamp duty for additional properties above your own home.

- Tax relief on costs restricted to basic rate 20%

- Restriction of Buy to Let mortgages by applying new affordability rules for the landlord including your own home mortgage and spending

- Raising the rental cover from 125% to 145%

- Higher agent’s costs

- Landlord obligations to ensure tenants have the right to reside in the UK – with possible prison sentence if you get it wrong

- Higher Health and Safety requirements, more annual checks and associated costs – with potential manslaughter charges if you omit the checks

- Removal of the 10% furniture and fittings allowance

Click Here for more about why Buy to Let is getting more of a problem.

So if direct ownership is unattractive, unaffordable and unavailable what options are left for a property investor?

There are 2 main alternative routes – an Institutional property fund or Joint Equity Bonds

Institutional investment. This has been promoted since 2010 by successive Governments but has not taken off so far in any meaningful way. The Montague Report cites the following as reasons why its not taking off.

- The income yields on residential property are too low and especially compared to commercial property. The MontagueReport quotes net yield of 3.5% historically

- High management costs as investment properties are managed by small local agents

- High financial risks including voids and damage.

Click Here for more on property funds and a copy of the Montague Report

Joint Equity Bonds which only support Joint Equity Co-Ownership Properties

The advantages of JEIP Bonds are:-

- Secure, the JEIP SPV only invests in Joint Equity Co-Ownership properties

- Each JEIP has its own portfolio of properties

- Reduced risk by spreading property ownership across locations and Resident Partners

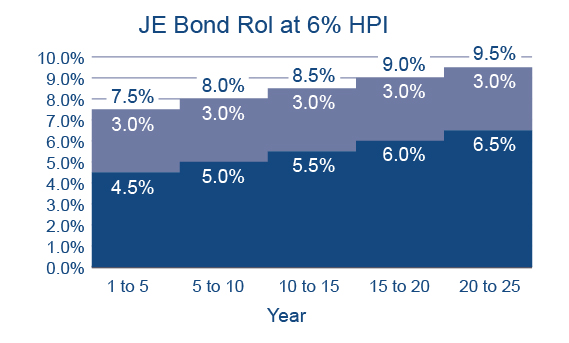

- Several Bond options offering fixed returns or variable linked to Halifax Property Index.

- Simple to understand for both the Resident Partner and the investor

- Higher returns than Buy to Let or institutional investments.

- Saleable, the Bonds can be traded, you are not tied into the investment until maturity date

- The long term Bonds have increasing rates of income return the longer they are held which will be reflected in the resale value

- Terminal bonuses are assessed quarterly and will reflect in the resale value.

- Large market estimated at over 750,000

- Ethical investment, not only is the rate of return attractive the investment helps aspiring home owners buy their own home and leave the rental trap